Alcohol Alternative

BlueTriton, Primo Water, Advantage Solutions, L.A. Libations, Athletic Brewing, PepsiCo Beverages North America, Coca-Cola India, and More

Read More

Executive Q&A: Keurig Dr Pepper CEO Tim Cofer, Executive Chairman Bob Gamgort

Company Has ‘One Leader,” Gamgort Says of Leadership Transition to Cofer

Read More

Monster, Red Bull Post 2023 Growth. Underperform Category.

Celsius Exceeded $1 Billion in Sales

Read More

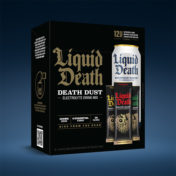

Powder Boom: Liquid Death Adds ‘Death Dust’ Electrolyte Sticks

Kraft Heinz Adds Functional and Mixer Lines to Crystal Light

Read More

Report: Red Bull, Coke, Celsius Top Influencer Marketing ROI Leaderboard

Influencer-Founded Prime Holds No. 4 Slot Among Non-alcoholic Beverage Brands

Read More

Future Smarts Highlights From Coke, PepsiCo, KDP Leaders

Coke North America President Mann to Keep Volume Pressure in Focus.

PBNA Supply Chain Chief Jordan Talks AI, Automation, Electric Trucks.

Whitmore Intent on Territory Optimization. Watching U.S. Alcohol Sector.

Read More